Agile is Dead. Long Live Agility.

For two decades, enterprises have chased the promise of “going agile.” Stand-ups replaced status meetings. Squads replaced project teams. Business units become value streams. Frameworks like SAFe promised to scale agility to thousands of people. But it never quite worked.

The irony is sharp. Agile was meant to liberate teams from bureaucracy – but in most organizations, the agile evangelists created a new kind of rigidity, one where Agile was the end goal, not agility, speed and value. Purist agile models collapsed under the raw weight of the documents that were written on “ways of working”. Fixed sprint cadences, prescriptive ceremonies, and one-size-fits-all frameworks worked well for teams, but not for the reality of enterprise organizations with hundreds of initiatives, regulated environments, and complex funding structures – and a stock market to report to.

Most attempts to truly scale agile radically underestimated the complexity of an enterprise organization.

The problem isn’t agility. The problem is that agile set out to emancipate us from bureaucracy, and then wrote several tomes of conflicting rules and regulations that must be followed, in order to successfully escape bureaucracy . It was defeated by its own purpose.

Strategic Portfolio Management (SPM) has emerged as the pragmatic answer: combining the strategic clarity and control of traditional portfolio management with the adaptability and speed of modern ways of working.

Instead of rejecting what came before, SPM builds on it, and is the flexible, outcome-focused framework that enterprises have been searching for all along.

What is Strategic Portfolio Management?

Strategic Portfolio Management (SPM) is an enterprise framework that connects strategy, funding, and execution in real time. It combines the financial discipline of traditional portfolio management with the adaptability of modern delivery methods – creating a unified system that aligns all investments to business outcomes, not delivery methodologies.

The organizations that benefit most are those managing scale, regulation, and constant change. SPM provides a single lens to govern confidently, align globally, and adapt at speed.

Where Did SPM Come From?

Over the past two decades, portfolio management evolved through three phases – each responding to shifts in scale, technology, and the balance between agility and control.

The dawn of connected work (Late 1990s–2000s) PPM (Project Portfolio Management)

As enterprises scaled delivery across functions, geographies, and technologies, the need for structure exploded. PPM brought control and visibility to an increasingly complex delivery landscape. Leaders finally had a way to manage budgets, timelines, and resources across increasingly complex networks of work. Projects were planned in detail, tracked rigorously, and governed through stage gates. These methods worked well for predictable, sequential work, but their rigidity became a liability as markets accelerated and customer expectations shifted faster than annual planning cycles could accommodate.

The explosion of digital delivery (2010s)

APM (Agile Portfolio Management)

As digital delivery exploded across the enterprise, agile methods spread beyond software teams. Organizations needed portfolio-level frameworks that could match this new pace. SAFe and similar approaches emerged, promising the speed and adaptability of agile at scale. In practice, pure agile governance often created more chaos than clarity. But the experiment was not wasted: APM revealed critical truths – the value of shorter planning cycles, organizing around customer outcomes rather than project structures, and the power of transparency and continuous adjustment. These lessons stuck, particularly in technology delivery and digital transformation.

The emergence of integrated work (Today)

SPM (Strategic Portfolio Management)

Strategic Portfolio Management represents more than a compromise between control and agility – it transcends both. It moves beyond methodology debates to offer a unified way of connecting strategy, funding, and delivery in real time.

SPM provides the financial discipline enterprises need and the adaptability teams depend on. It creates a single, outcome-driven framework for orchestrating complex ecosystems of work – integrating top-down direction with bottom-up empowerment, without diluting either.

image:borderless

💡 SPM provides a holistic, strategy-to-execution model that works across projects, agile initiatives, and hybrid approaches – aligning all investments and resources to business outcomes, not delivery methods.

What SPM Inherits From PPM and APM

SPM avoids the PPM trap of excessive rigidity where projects become control mechanisms divorced from strategy. It also avoids the APM trap of pure autonomy that creates unpredictability at enterprise scale.

Instead, SPM fuses financial predictability with strategic adaptability. Every investment is well-governed, but governance focuses on value delivery and strategic progress – not just compliance with process.

From PPM:

- Financial discipline: Budgeting, forecasting, and ROI measurement remain essential at enterprise scale

- Governance at scale: The ability to monitor investments, risks, and dependencies across hundreds of initiatives

- Portfolio visibility: Executive line of sight across the full portfolio to make informed trade-offs

From APM:

- Iterative planning: Shorter cycles of adjustment rather than annual rigidity

- Value orientation: Organizing around strategic objectives and customer impact, not arbitrary project boundaries

- Adaptive delivery: The ability to pivot quickly and release value continuously

- Team empowerment: Autonomy within guardrails that tie back to enterprise strategy

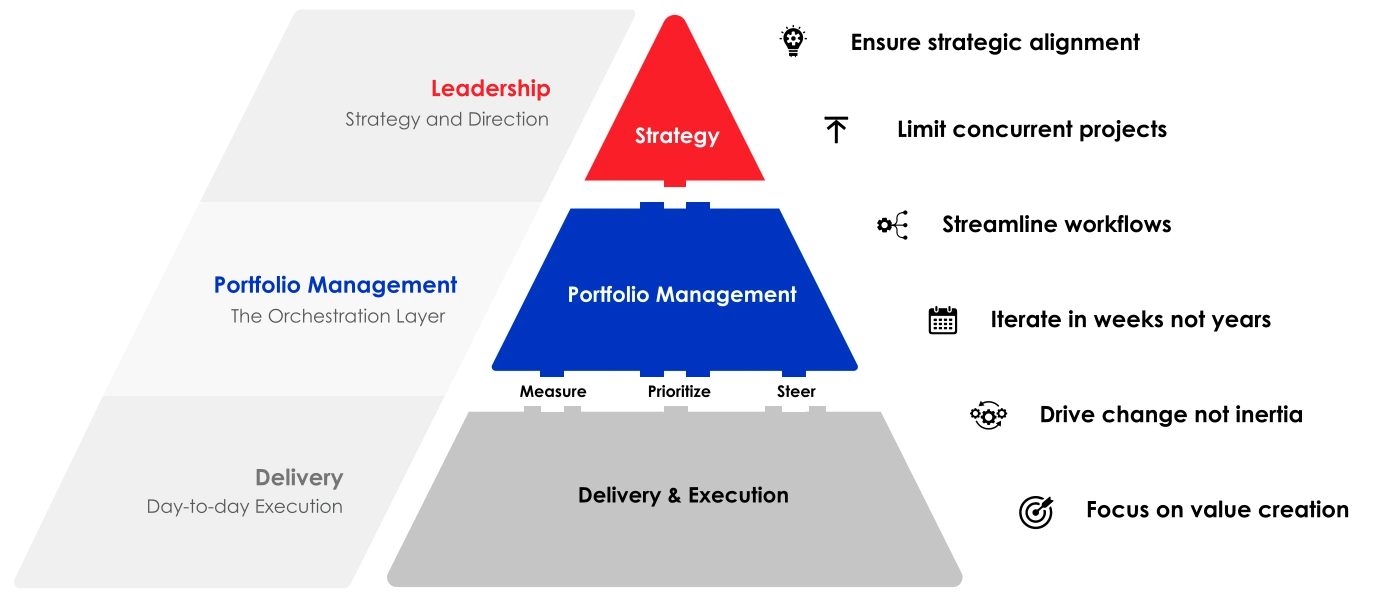

Structurally, this integration works across three layers:

image:borderless

From PPM to APM to SPM: What Changed and Why It Matters

The following table details how Strategic Portfolio Management differs from it’s predecessors, Project Portfolio Management and Agile Portfolio Management.

| Theme | PPM | APM | SPM |

|---|---|---|---|

| Strategy & Prioritization | Strategy sits outside portfolio management; focus is on tracking benefits post-hoc. Prioritization is basic cost–benefit. | Bottom-up, team-led prioritization. Excellent at team level, but chaotic at enterprise scale. Strategic alignment often an afterthought. | Combines top-down strategic direction with bottom-up insight. Enterprise priorities are clear, but teams have agency to shape how outcomes are achieved. |

| Governance | Heavy stage gates, rigid processes, annual budgeting cycles. Control and bureaucracy dominate. | Most governance abandoned; focus is on sprint or PI goals. Anything beyond the next increment is often ignored. | Annual budgets remain, but governance is adaptive: quarterly business reviews, flexible funding, prioritization and re-prioritization as the year unfolds. Decisions are guided by outcomes, not rituals. |

| Delivery | Waterfall delivery: milestones, task hierarchies, critical paths. | Agile only: story points, sprints, iterations. No concept of “projects.” | Delivery method is deliberately not prescribed. Teams choose the right approach. Leadership focuses on visibility and outcomes, not enforcing a delivery methodology. |

| Reporting | PowerPoint packs, weekly status updates, manual consolidation. | Jira and Confluence dominate. Executives often blind; PMOs stuck translating or improvising because they can’t access or interpret team tools. | Real-time, integrated reporting across Jira, ADO, ERP and financial systems. Waterfall and agile data flows converge into a single view of progress against outcomes. |

| Financials | Fixed annual budgets tied to projects. Funding locked in early; change is slow and painful. | Team-based funding or PI funding with little connection to enterprise financial structures. Difficult to track costs accurately at scale. | Funding is tied to strategic outcomes. Budgets are set annually but flexed quarterly. Money follows priorities, not the other way around. Clear line of sight between financial data and delivery progress. |

| Benefits / Goals | Benefits tracked retrospectively; often separate from delivery. Focus on outputs, not outcomes. | Goals framed at team level. Strategic benefits often implicit or assumed. Measurement inconsistent. | Benefits and goals are defined upfront and tracked continuously. Delivery data and business metrics are connected to measure actual progress towards strategic outcomes. |

| Resourcing | Centrally planned, role-based allocations. Optimizes for utilization, not outcomes. | Team capacity managed locally. Great for autonomy, but opaque at enterprise level; hard to redeploy capacity strategically. | Resource planning is integrated. Strategic capacity signals meet team-level data. Organizations can see where capacity sits and redeploy intelligently, without undermining team autonomy. |

SPM in Action: A Strategy Execution System

Strategic Portfolio Management treats the portfolio as a strategy execution system as opposed to just a project tracking exercise.

In practice, that means leaders asking questions that don't normally get space in traditional reviews: is this still the right thing to fund? should we stop this? does this initiative still justify the people tied up in it?

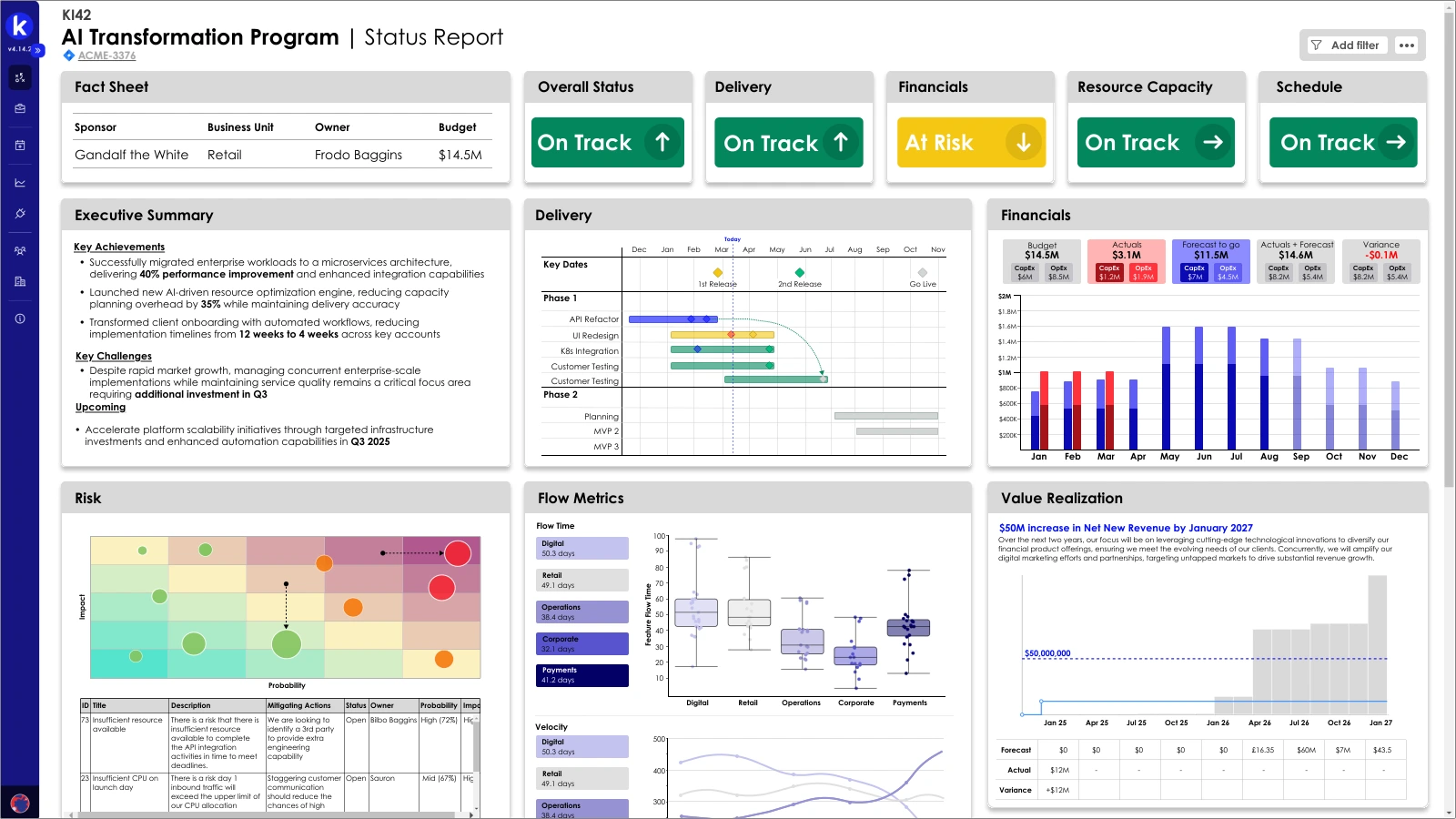

The dashboard below shows an SPM system in action – budget, delivery status, resource capacity, and value realization visible in one integrated view. Leaders can see which initiatives are tracking to strategic objectives, where capacity is deployed, and whether benefits are landing.

Learn more about this dashboard and executive status reports in this article.

💡 This visibility enables the agility that makes Strategic Portfolio Management effective. The real barrier is often cultural: most organizations have trained portfolio leaders to think in annual cycles and avoid mid-year changes. SPM requires seeing portfolio reallocation as normal governance, not crisis management.

The Benefits of Strategic Portfolio Management – and Why They Matter Now

SPM changes the conversation in the boardroom. Executives no longer debate whether transformation spend is justified because the line of sight from investment to outcomes is clear. When market conditions shift, the portfolio can react with them – capital flows to where it creates the most value, rather than staying frozen in yesterday's priorities.

When competitors can pivot in quarters instead of years, SPM becomes a competitive differentiator. While traditional portfolios could take 6-12 months to reallocate major funding, organizations with the frameworks to support Strategic Portfolio Management can redirect resources within weeks of identifying new priorities.

This strategic agility is built on operational capabilities that change how portfolio teams work day-to-day:

- Capital flows to progress: funding redirects to initiatives that demonstrate validated progress, rather than staying trapped in commitments that lost strategic relevance.

- Trade-offs become visible: leaders see the full portfolio and can weigh resilience, compliance, and growth investments against each other, rather than approving everything and hoping capacity materializes.

- Low-value work concludes faster: initiatives that no longer serve strategic objectives get stopped, freeing capacity for work that matters.

- Progress becomes measurable: advancement toward strategic objectives (cost reduction, churn improvement, compliance) is tracked continuously, not assumed at project approval and forgotten until annual reviews.

- Risk surfaces early: leaders see problems developing and can step in before they escalate, rather than discovering issues only at year-end reviews.

How SPM Delivers Value for CTOs, CIOs, and CFOs

Strategic Portfolio Management addresses the distinct challenges facing technology and finance leaders:

For CTOs

CTOs struggle to accelerate technology-driven innovation while reducing organizational complexity. Technology roadmaps often lack organizational buy-in, and the path from experimentation to production deployment remains slow and unpredictable.

SPM provides visibility into how innovation investments translate to business capabilities, surfacing where organizational constraints slow technology adoption. CTOs can track initiatives from experimentation through scaled deployment while demonstrating clear connections between technology strategy and business outcomes.

For CIOs

CIOs need to connect disparate parts of the organization to drive value, but lack the performance measures and visibility needed to demonstrate impact. Data, process, and decision roadblocks inhibit teams' ability to deliver, while misalignment across technology leaders creates duplication and wasted capacity.

SPM provides end-to-end visibility across technology delivery, surfacing dependencies, capacity constraints, and delivery confidence. CIOs gain the enterprise line of sight needed to eliminate bottlenecks, align technology leadership, and demonstrate how operational capabilities drive business outcomes.

For CFOs

CFOs are caught between the need to enable organizational agility and the requirement to maintain financial discipline. Traditional governance creates data complexity and slows decision-making, while limited visibility into transformation investments makes it difficult to assess returns or redirect capital.

SPM provides clear line of sight from portfolio investments to business outcomes, with real-time visibility into transformation ROI. CFOs gain the financial transparency and governance frameworks needed to enable speed without compromising quality, with the flexibility to redirect capital as priorities evolve.

SPM as an Evolution, Not Revolution

Strategic Portfolio Management doesn’t require tearing up existing processes. In fact, most organizations have already laid much of the groundwork through previous agile transformations. What’s often missing is the layer that connects those ways of working back to the practical enterprise realities of strategy, funding, and outcomes.

Most organizations don’t suffer from a lack of frameworks; they suffer from fragmented views. Finance has one set of numbers. Delivery has another. Strategy sits on its own island. By the time they’re stitched together, the picture is already out of date.

SPM fixes the view. It gives leaders real-time visibility across the portfolio and creates the alignment needed to get the whole organization moving in the same direction. This isn’t a radical transformation. It’s the enterprise wrapper that connects strategy, funding, and execution with minimal dogma and maximum pragmatism, focusing everyone on value.

image:medium

The organizations that embrace it treat their portfolios as living systems , continuously aligning strategy, funding, and execution. Those that don’t remain trapped in static cycles that can’t keep pace with change.

See Strategic Portfolio Management in action. Kiplot connects strategy, funding, and execution in real time – providing the portfolio visibility, adaptive governance, and financial flexibility described in this guide.

Read the Solution Overview or request a demo to learn more.