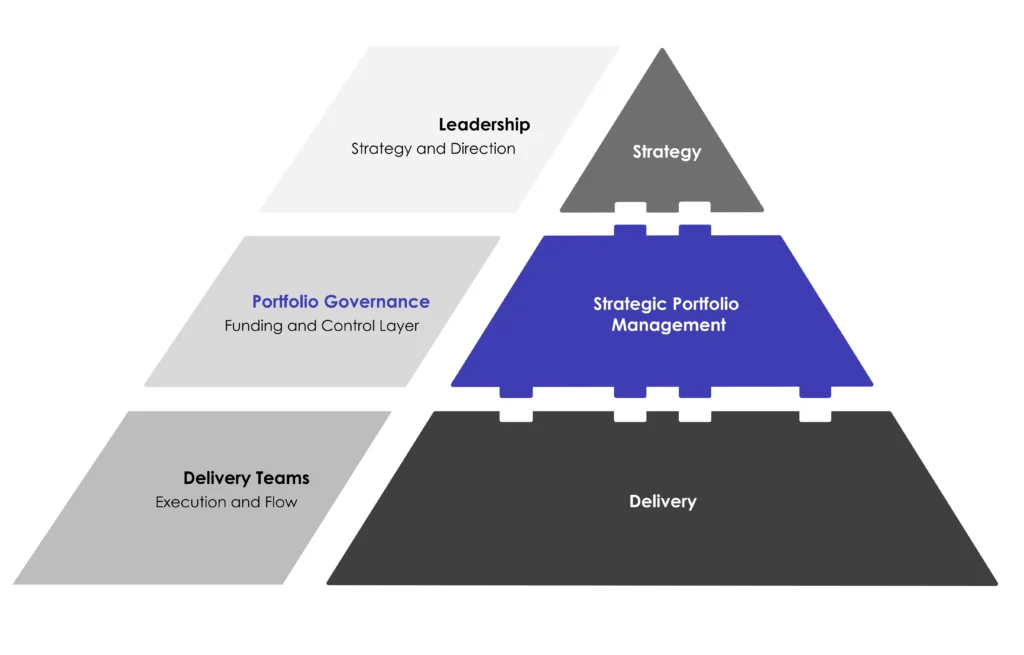

Strategic portfolio management is the executive discipline of aligning an organization's portfolio of initiatives with its strategic objectives, while continuously optimizing resource allocation and investment decisions across changing business conditions.

image:medium

image:borderless

In enterprise organizations, coordination costs increase with portfolio size and delivery model diversity. Without clear governing logic, portfolios fragment into disconnected projects and resources misallocate to low-impact work. These five principles provide the decision-making framework that separates effective strategic portfolio management from reactive project coordination.

1. Strategic alignment governs all resource allocation decisions

Portfolio resources flow only to initiatives with explicit ties to strategic objectives and quantifiable business outcomes. When alignment cannot be demonstrated, funding is withheld or reallocated.

Without this discipline, organizations fund initiatives that don't support strategic goals. Resources get spread across business units with no coordination. Projects continue because they're already in flight, not because they deliver value.

Effective portfolio management maps each initiative to specific business objectives with clear success metrics. Leadership reviews alignment regularly as business conditions change. Cross-functional accountability ensures initiatives stay coordinated across the organization.

2. Expected value determines priority, not ease of execution

Resource allocation decisions prioritize initiatives based on their potential to deliver measurable business outcomes. How busy teams are or how many projects they complete are not valid priority criteria.

Most organizations measure success by counting completed projects. These metrics tell you how active teams are, not whether the work matters. The real failure is mistaking utilization for return.

Effective prioritization evaluates initiatives against concrete outcomes like revenue growth or cost reduction. Resources go to work with the highest expected value, even if it's harder to execute. Regular feedback tracks whether initiatives deliver what was predicted.

3. Capacity responds to strategy, not forecasts

Resource allocation adapts continuously to strategic priorities. Long-term capacity plans give way to real-time strategic demands when needed.

Many organizations plan capacity months in advance and then can't adjust when priorities change. Critical work gets delayed because resources are locked into less important projects. The mismatch between capacity and priorities creates both delivery risk and wasted resources.

Effective capacity management provides real-time visibility into who's available and what they're working on. Rolling-wave planning revisits capacity decisions at regular intervals. Cross-functional resource pools let organizations move people between departments as strategic needs evolve.

Because most enterprises operate hybrid capacity models spanning project-based and team-based delivery, capacity decisions require explicit governance; this guide explains how organizations reconcile forecast-driven and flow-based planning in practice.

4. Decisions are made from integrated data, not reconciled reports

Leadership needs a single source of truth that shows resource allocation, financial performance, delivery progress, and risk exposure in real time.

When data lives in separate systems, executives can't see the full picture. Dependencies between teams go unnoticed until they cause delays. Risks grow before anyone flags them. Reconciling data from multiple sources takes time, which means decisions get made on outdated information.

Integrated dashboards pull data from across the portfolio into one view. Real-time updates surface dependencies, risks, and capacity constraints early enough to address them. Predictive analytics let leadership model different scenarios before committing to changes.

Sustaining portfolio-level decision quality depends on enterprise architecture that aligns systems, data models, and governance; this article explains how architecture enables strategic portfolio decisions rather than fragmented reporting.

5. Portfolio practices evolve based on outcomes, not policy

Portfolio management processes and resource allocation models adapt based on performance data and changing business context. Improvement happens continuously, not in periodic overhauls.

Without regular reflection, portfolio management gets stuck using approaches that no longer fit current needs. Teams keep executing plans that don't reflect today's strategic reality. Organizations make the same mistakes repeatedly because they don't capture what worked and what didn't.

Effective portfolio management builds in feedback at both strategic and execution levels. Portfolio reviews assess how well resource allocation and governance performed against objectives. Regular communication between business leadership and delivery teams enables course correction while work is in progress.

From principles to practice

This article defines the decision-making principles that govern strategic portfolio management. These principles translate into specific organizational capabilities: integration mechanisms, prioritization frameworks, capacity planning systems, data architecture, and improvement cycles.

The companion article about Strategic Portfolio Management explains how organizations build these capabilities through governance frameworks, operating models, and technology enablement.

Implementing these principles requires integrated systems that consolidate initiative tracking, resource planning, financial oversight, and predictive analytics. Purpose-built platforms provide the visibility and analytical capabilities needed for effective portfolio management. Kiplot enables organizations to implement these principles within a single platform.

Learn how strategic portfolio management software supports these principles.

Conclusion

Strategic portfolio management separates organizations that execute strategy from those that simply manage projects. The five principles above define how leadership allocates capital, prioritizes work, and adapts to changing conditions. Applying them consistently is what makes portfolio management strategic rather than administrative.