Portfolio Planning

Implementing accrual in agile organizations

What is accrual?

Accrual is the process by which costs that have been incurred but not paid are accounted for. You can think of it like a credit card. At the end of the month, the transactions in your bank account are not a complete representation of the money that you have spent that month. You must also take into account your credit card bill. Your credit card bill shows costs that you have incurred, but not yet paid.

In an organizational context, accrual is particularly important for keeping track of third party costs. At the end of the month, employee salaries will be paid. But typically, third parties will submit invoices at the end of the month. Depending on the payment terms, this invoice may not be paid for 30, 60 or even 90 days. That means that although the cost has been incurred, the organization will not “see” the actual cash leave its account (”the ledger”) until much later. This presents a cost management challenge. In order to understand at any given point in time how much my project, initiative, team or value stream has spent, I must take into account not only my cash actuals (i.e. money that has been paid) but also cost that I have accrued.

In this article, we’ll explore how to calculate accrual, the responsibility that teams have outside for finance for keep on top of it, and best practice for implementing accurate accrual.

The $20M challenge.

Accrual accounting is critical to cost control. The bigger the organization, the more important it is and often, the more complex it is. The more third parties are used as part of your organization’s delivery, change and engineering capability, the bigger this challenge becomes.

Let’s take a simple worked example:

- A single initiative starts in January and I have contracted a third party to lead the delivery. They are providing 10 resources at a cost of $200K/month (~$1K/day).

- At the end of the month, the supplier submits their invoice. Let’s assume they submitted it on time, and it travels unencumbered through the organization’s business processes (big assumption!). The payment terms with the supplier are 60 days.

- When the actuals for this initiative are calculated at the end of the month, no money has been paid to this supplier. Therefore, if my initiative is not incurring any other costs, the first month’s actuals for my initiative will be $0.

- At the end of February, the third party submits a second invoice for $200K. But the total actuals for my initiative remain at $0 as only 30 days have passed since January’s invoice was submitted.

- My project has “accrued” $400K in cost, but my actuals are showing $0.

- Let’s now say there are 50 similar initiatives running in parallel across the organization. Suddenly the total value of accrual across all of these projects becomes a $20M. If the organization loses track of this, there’s going to be a very nasty surprise down the line.

Following this worked example, it is easy to imagine how executives may begin to make significant decisions based on incorrect information.

“We’re underspending by $20M – let’s pursue that strategic initiative we thought we couldn’t afford”

Keeping a firm handle on accrual is a core part of what it means to be an agile organization. Continuous funding of teams often makes this more, not less challenging.

How do I calculate accrual?

Conceptually, accrual is straightforward to calculate:

💡 Accrual = Forecast – Actual

But what does this really mean?

The equation means that accrual is calculated by taking the forecast for the initiative and subtracting the actuals. In the example above, had we forecasted $200K in January for our third party, we would have accrued $200K because our actuals were $0.

So conceptually, this is straightforward, right?

The crux of the challenge is how to ensure the forecast is accurate at any given point in time. To do this, we need to understand where resources are spending their time.

Accrual best practice for precision cost control

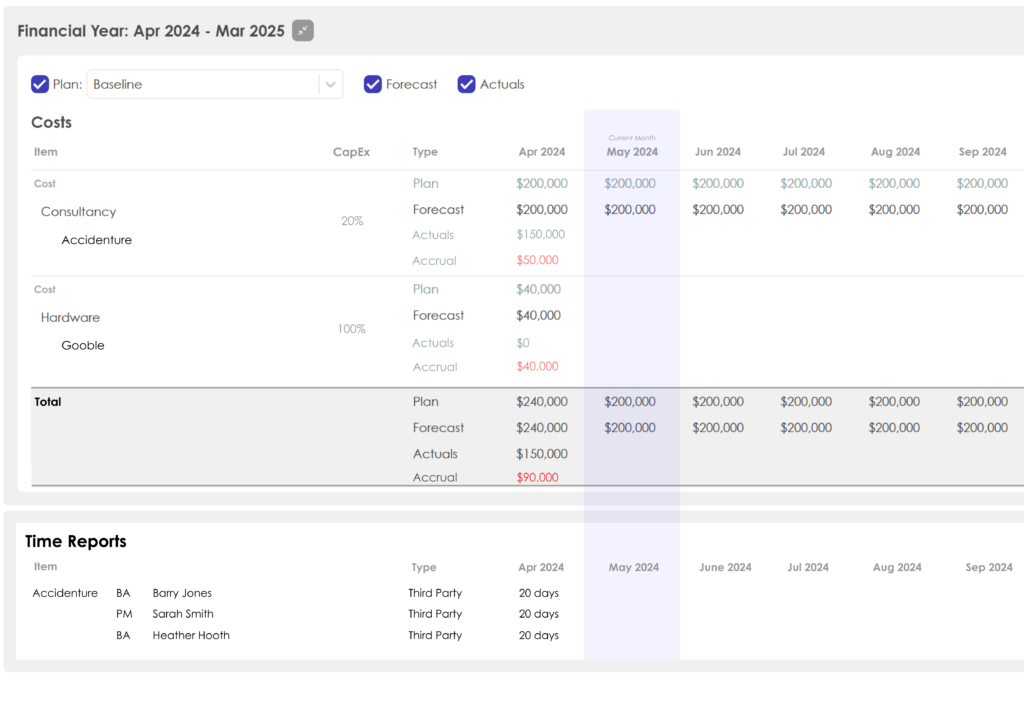

Connect time recording to forecasts

Too often organizations treat these two capabilities as entirely separate and end up in a sea of spreadsheets, big (dangerous) assumptions and painful quarterly reconciliations. The process your organization should be aiming for is one where the time sheet that a resource submits can be automatically compared, inline with the forecast. Putting all of this information together, in one place, allows for laser focused control, and drives accountability to delivery teams who are typically much closer to the reality on the ground.

Separate “plan” from “forecast”

A common mistake we see is exercising governance and/or guardrails around the forecast. This creates two problems:

- Confusion arises about the responsibility and accountability of delivery teams in relation to the forecast. Are they supposed to change the forecast? Perhaps the forecast should never be changed? Should they seek governance approval to do this?

- Fear of recrimination adds to this challenge as teams seek to avoid updating their forecast to avoid top scrutiny

Instead, organizations should separate the concept of the “plan” and the “forecast”. The forecast should be treated as a fluid ungoverned view of how cost has been incurred, and will be incurred into the future. This is separate from the “plan”. The plan is the approved profile of spend – this should be governed by carefully set guardrails. It is important that organizations avoid confusing these two concepts.

Ensure accrual is transparent

Ensuring that the process of calculating and accounting for accrual does not become a finance black box that your organization doesn’t understand is vital. To make this work, focus on process connectivity. Accrual should be visible (and preferably automatically calculated) in the the same place that forecasts are managed. This will also drive improved accountability within the delivery teams and projects.

Note non-finance teams should generally not be given the ability to adjust accrual – instead, there should be transparency across actuals, forecast, plan and accrual at any given point in time, and a common understanding of how these concepts interact with each other.

Enforce guardrails around accrual

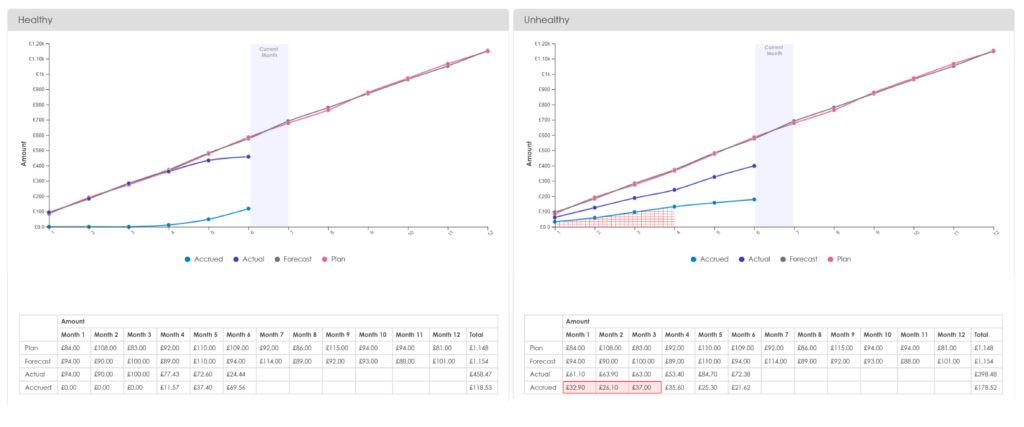

A healthy initiative should not carry significant accrual more than 3 months into the past. By retaining data about when the cost was expected to be incurred, we can track how long the initiative has been “carrying” the accrued values.

An initiative that is perennially pushing cost into the future is unlikely to be undertaking accurate cost management. Conversely, an initiative that is carrying around 3 months of accrued cost any point in time (and nothing behind that) is much more likely to be actively managed. There is nothing unhealthy about an initiative carrying accrual, provided the accrual is balanced by actuals that follow in the subsequent months.

A good rule of thumb is to watch out for initiatives carrying accrual for more than 3 months:

Conclusion

Accrual accounting, while complex is indispensable for agile organizations that strive for financial precision and transparency. As we navigate the nuances of value stream delivery, project management and cost control in fast-paced environments, understanding and implementing effective accrual strategies becomes paramount. By breaking down projects appropriately, simplifying time tracking, and maintaining a clear distinction between plans and forecasts, organizations can manage their finances with greater precision and ultimately, get better value for money.