A Practical Guide to Portfolio Maturity and the Behaviors That Define It

Introduction

Portfolio maturity is one of those terms that gets thrown around in boardrooms and strategy decks without anyone stopping to define it. Leaders nod along, assuming everyone shares the same mental model. They rarely do.

The result is predictable: organizations chase maturity as if it were a destination, investing in tools and frameworks without a clear picture of what "good" actually looks like, and measuring process activity rather than value created.

This article cuts through the ambiguity. It defines what portfolio maturity looks like in practice and sets out the observable behaviors that separate mature portfolios from immature ones.

The assessment at the end provides you with a structured way to benchmark your own portfolio and offers a scoring breakdown and PDF report with tailored recommendations.

You can benchmark your portfolio’s maturity using the structured assessment here.

Maturity Is Not a Destination

Portfolio maturity is not a final state, a certification or something you achieve by implementing a particular tool or framework.

Portfolio maturity is better understood as the degree to which an organization can make and adjust investment decisions with confidence because priorities, funding, capacity, and delivery conditions operate as one governed system.

You see maturity in the speed and quality of decisions. You see it in consistency of delivery under pressure. And you see it in how little corrective effort is required when external pressures reshape planned work.

The goal is not to reach some absolute endpoint. Portfolios exist in changing environments. What matters is how far your organization has moved along the spectrum from fragmented control to governed alignment.

Characteristics of a Mature Portfolio

Mature portfolios share observable behaviors that distinguish organizations with genuine portfolio discipline from those still wrestling with fragmented data and reactive decision-making. These characteristics form a practical maturity model that reflects real executive behavior rather than theoretical frameworks.

1. Clarity at the Moment of Decision, Stability in What Follows

Portfolio maturity reveals itself most clearly in decision moments.

In low-maturity environments, a single new request triggers parallel scrambles across finance, delivery and resource teams to reconstruct the truth. Leaders wait while numbers are reconciled and impacts are guessed at. The organization assembles the picture manually because funding, capacity, dependencies, and delivery conditions sit in different places.

In mature portfolios, trade-offs are already visible. Decision-makers see the consequence of a proposed change immediately because the underlying constraints are connected and live, so no bespoke analysis is required. The organization acts at the speed the decision demands.

Mature portfolios see both the direct and cascading effects of a proposed change before a decision is made, so leaders understand the consequences in advance rather than discovering them after the fact.

Mature portfolios also maintain stability after decisions are made. When plans need to adjust, the organization can rebalance work without disruption. Stability of response replaces stability of plan.

2. One Version of Reality

In mature portfolios, strategy, funding, and delivery operate from the same data. Information flows into a single governed source, so the entire organization sees one coherent view of what is happening.

The test is simple: when someone asks for the latest position, every team from strategy, finance, and delivery gives the same answer.

Low-maturity portfolios generate parallel versions of the truth. Delivery describes progress, finance describes spend, resource owners describe availability. None of them is wrong, yet the variance between them is too wide for confident decisions. Leaders spend their time interrogating data rather than acting on it.

Mature portfolios eliminate this sprawl and maintain that discipline. They resist regression into custom spreadsheets, reports, and locally curated numbers that bypass the governed system. Data discipline is treated as part of the operating model instead of an administrative task.

3. Work Flows Through the System in a Governed Way

A portfolio can look structured from a distance yet behave unpredictably at its edges. The real test is how work enters the system and progresses once inside.

In low-maturity environments, this is where gaps appear: initiatives bypass intake, priorities are advanced through informal channels, and delivery teams absorb unsanctioned work because there's no governed mechanism to say no.

In mature portfolios, flow is controlled. Intake is governed and prioritization follows agreed criteria. Work in progress reflects what leadership believes is happening. Exceptions exist as they always do but they are visible, deliberate and managed rather than accidental.

In practice, methodology becomes secondary. Teams may use agile, traditional, or hybrid approaches, but behavior is shaped by governance rather than by the mechanics of a framework. The result is consistent output without restricting how teams deliver.

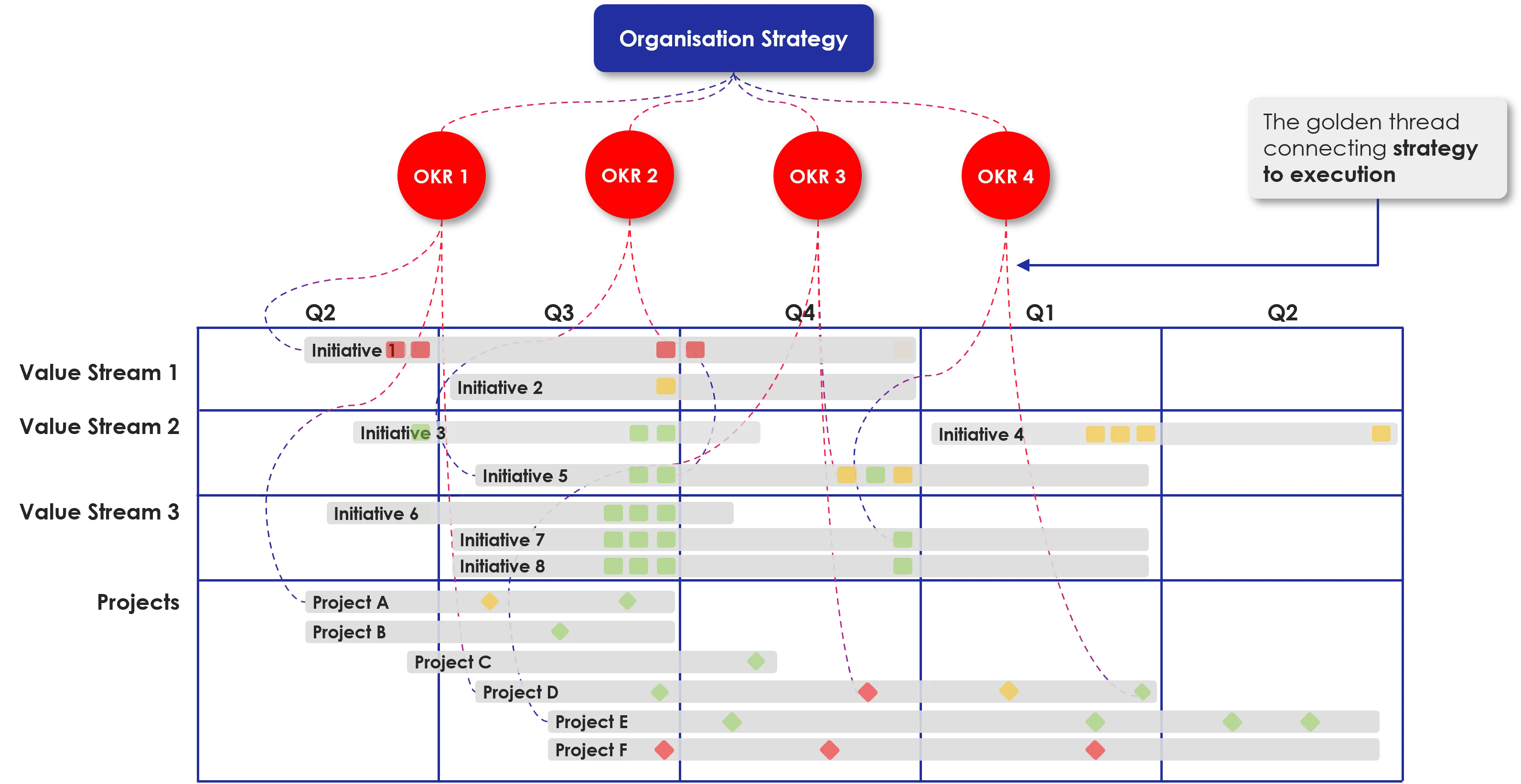

The diagram below illustrates what governed flow looks like when strategy, value streams and delivery operate from the same structured system.

4. Outcomes Stay Visible From Approval to Delivery

In low-maturity organizations, the business case vanishes as soon as execution begins. This creates a significant challenge for benefit realization because no one remembers what they were supposed to measure in the first place.

In mature organizations, the business case remains visible throughout the initiative's lifecycle. Initial intent stays in view, and decisions are made based on evidence rather than sunk cost sentiment.

This matters because it determines whether you can answer the most important question: are the intended outcomes materializing.

If you want a quantified view of these behaviors, start the assessment.

Common Gaps That Hold Organizations Back

Understanding the characteristics of maturity is useful. But most organizations aren't starting from zero. They're stuck somewhere in the middle, with specific gaps holding them back. Below are the patterns we see most often.

Gap 1: Data Exists, But Doesn't Connect

Many organizations have invested heavily in tooling. They have project management systems, financial platforms, resource databases, and reporting dashboards. The problem is that these systems don't talk to each other. When they do, the integration is brittle and manually maintained.

The symptom is familiar: every reporting cycle involves someone pulling data from multiple sources into a spreadsheet to create a "consolidated view." It creates the illusion of coherence without delivering it.

Gap 2: Governance Exists on Paper, But Not in Practice

Process documentation looks comprehensive. Stage gates are defined. Approval workflows exist. But when you observe how work actually moves through the organization, you find a parallel system operating alongside the documented one.

High-priority initiatives bypass intake because a senior sponsor pushed them through. Resource commitments are made in meetings that never get recorded. Prioritization decisions happen informally, then get rationalized after the fact.

Gap 3: Capacity Is Managed Reactively

Organizations often have reasonable visibility into what work is planned. What they lack is reliable visibility into whether they have the capacity to deliver it.

Resource planning happens at the start of the year, then drifts as reality diverges from the plan. By mid-year, no one trusts the numbers. Capacity conversations become political negotiations rather than data-driven decisions.

The result is chronic overcommitment. The portfolio contains more work than the organization can realistically deliver, but there's no governed mechanism to force the trade-off.

A full maturity profile is available through the portfolio assessment.

Pitfalls to Avoid

Organizations pursuing portfolio maturity often make predictable mistakes. Here are three worth avoiding.

Pitfall 1: Treating Tools as the Solution

Tools enable maturity. They do not create it. Organizations that lead with technology before addressing foundational governance, data discipline, and ways of working typically end up with expensive systems that replicate their existing problems at greater scale.

The sequence matters: define what behaviors you need, then select tools that enable those behaviors.

Pitfall 2: Pursuing Maturity for Its Own Sake

Maturity is not the objective. Better decisions, faster delivery, and improved outcomes are the objectives. Maturity is simply the operating condition that makes those things possible.

Organizations that treat maturity as the goal often over-engineer their processes, creating governance overhead that slows them down rather than enabling speed.

Pitfall 3: Attempting Transformation All at Once

Portfolio maturity is built incrementally. Organizations that try to implement every capability simultaneously typically achieve none of them well. They create change fatigue, inconsistent adoption, and a perception that "this doesn't work here."

Building foundational capabilities before advancing to more sophisticated ones produces more durable results.

Next Step: Assess Your Portfolio

If you want a clear understanding of your current position, you can complete the short assessment below. It provides a benchmark of how your organization manages investment decisions, execution and outcomes.

The assessment benchmarks how your portfolio operates across governance, delivery, financial control, resource management and automation. It provides a structured view of where maturity is established and where gaps create risk, along with a report containing recommendations based on industry best practice.

The next step depends on your assessment result. But in general, the highest-leverage moves are:

- Establish a single source of truth. Before you can govern effectively, you need reliable data. This often means making hard choices about which system is authoritative and enforcing discipline around data entry.

- Make governance real, not ceremonial. Audit how work actually enters and moves through your portfolio. If the informal system has more influence than the formal one, fix that first.

- Connect capacity to commitment. Build mechanisms that surface the relationship between planned work and available capacity and create governance that forces trade-offs when they don't align.

- Shift reporting toward outcomes. Start measuring whether initiatives are achieving their intended results, not just whether they're on schedule.

- Build change resilience. Create portfolio-level mechanisms for absorbing change, rather than forcing each initiative to negotiate its own accommodation.

None of this is easy. But organizations that make progress on these fundamentals find that everything else becomes more tractable. Decisions get faster. Delivery becomes more predictable. And the portfolio starts to feel like a governed system rather than a collection of independent initiatives competing for attention.

Click here to assess your portfolio’s maturity.

For organizations building the foundations of strategic portfolio maturity, our Strategic Portfolio Management guidance provides a useful starting point.

FAQs

FAQ: What Is Portfolio Maturity?

Portfolio maturity describes how effectively an organization makes and adjusts investment decisions using a governed, connected system. A mature portfolio aligns priorities, funding, capacity and delivery conditions so decisions can be made with confidence and adjusted without disruption.

FAQ: How Do You Assess Portfolio Maturity?

Portfolio maturity is assessed by examining behaviors across governance, delivery, financial control, resource management and automation. The maturity assessment benchmarks these behaviors and provides a structured view of where your portfolio is aligned and where gaps create risk.